Startup Chart of Accounts Example & Free Template

Our chart of accounts examples & templates for SaaS, eComm and more help founders gain a clear understanding and view of their overall financial health

Your Chart of Accounts (COA) is Crucial

Your Chart of Accounts (COA) is Crucial

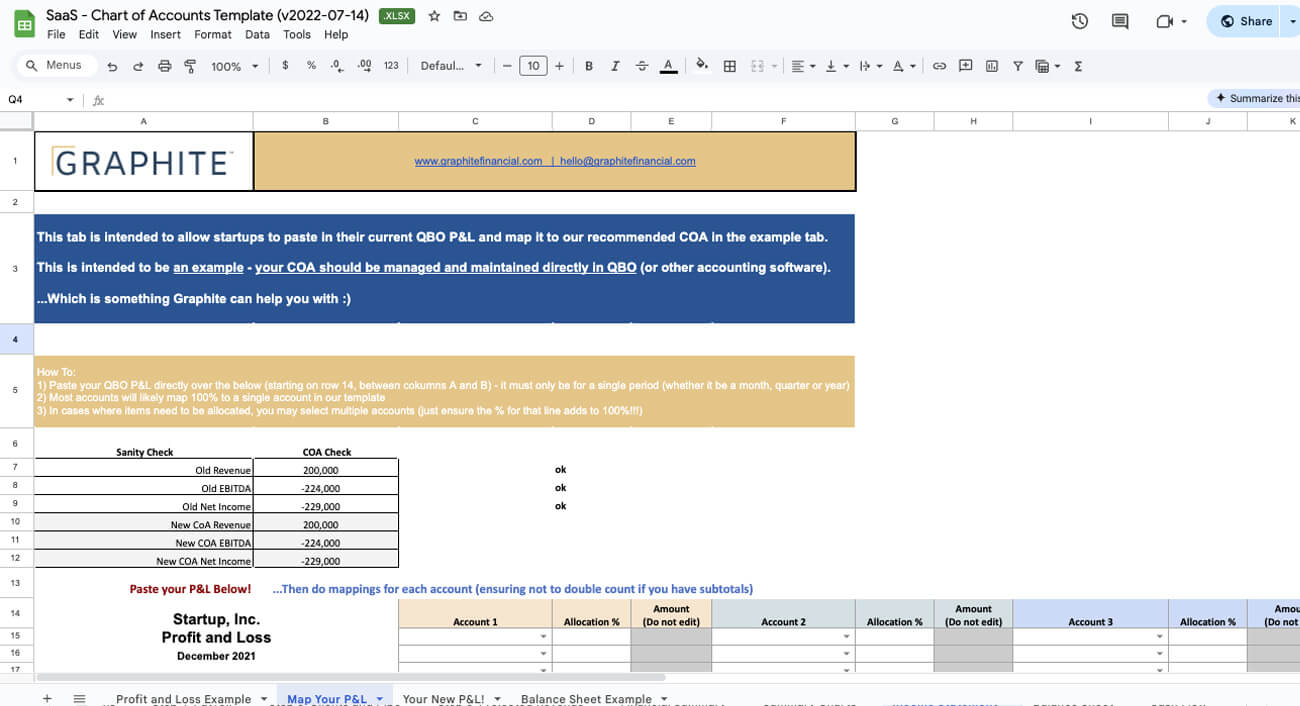

When we started Graphite, we realized most startups were using what we called the “QuickBooks Default” chart of accounts, or COA for short. Essentially, expenses outlined in Alphabetical order. This would look something like below:

Advertising, Bank Fees, Benefits, Commissions, Marketing, Contractors, Office Expenses, Payroll Taxes, Salaries, Software, Travel

…Not a big deal and easy enough when you have little going on. But when you start hiring a team, investing in tech, and investing in growth (aka you’re a venture backed startup) – this “Quickbooks Default” chart of accounts doesn’t tell you much

It’s crucial (and expected by investors) that founders be able to analyze the economics of their startup. For example, things like salaries…Product/Tech vs Sales vs Operations

That’s why we developed an industry specific startup chart of accounts example & template!

Download our Template Chart of Accounts

Simply fill out the form to download our free chart of accounts example & template. You will be re-directed to the download page where you can access the chart of accounts files.

Don't waste time building your own chart of accounts.

Let us do it for you. Graphite was born out of a VC fund and we take a thorough deep dive into your startup’s operations, develop customized financial models, and can act as your fractional CFO.

Get StartedNeed help with your accounting? Shoot us a message.

Born out of a VC fund, Graphite fully understands the strategic and financial needs of high growth companies. If you need accounting support or simply have a question about accounting at your company, feel free to connect with us!