How Do I Vet a Top Startup Accounting Firm?

The search for a top startup accounting firm is often intimidating. A quick Google search query will yield an overwhelming list of service providers claiming to be the financial partner for startups.

When browsing through these service providers, you’ll see plenty of bold claims. Anyone can claim to be a startup accounting expert, but the reality is that early-stage companies have unique financial needs in terms of strategy and support. Even the most skilled firms may not be the best choice because you have unique needs as a startup.

As a rapidly growing startup, you need financial support fast, and you likely don’t have the resources to test out dozens of partners until you find the right fit. This means that you need to be laser-focused on determining which accounting firm will deliver the results you need.

How to Disqualify Startup Accounting Firms Until You Find “The One”

We’ve already discussed what to look for when choosing a top startup accounting firm, but you’ll also need to keep an eye out for red flags.

Let’s discuss some ways to disqualify startup accounting firms during your search so you can avoid choosing the wrong partner and spend more of your time finding the best firm.

They Are Very Low Cost

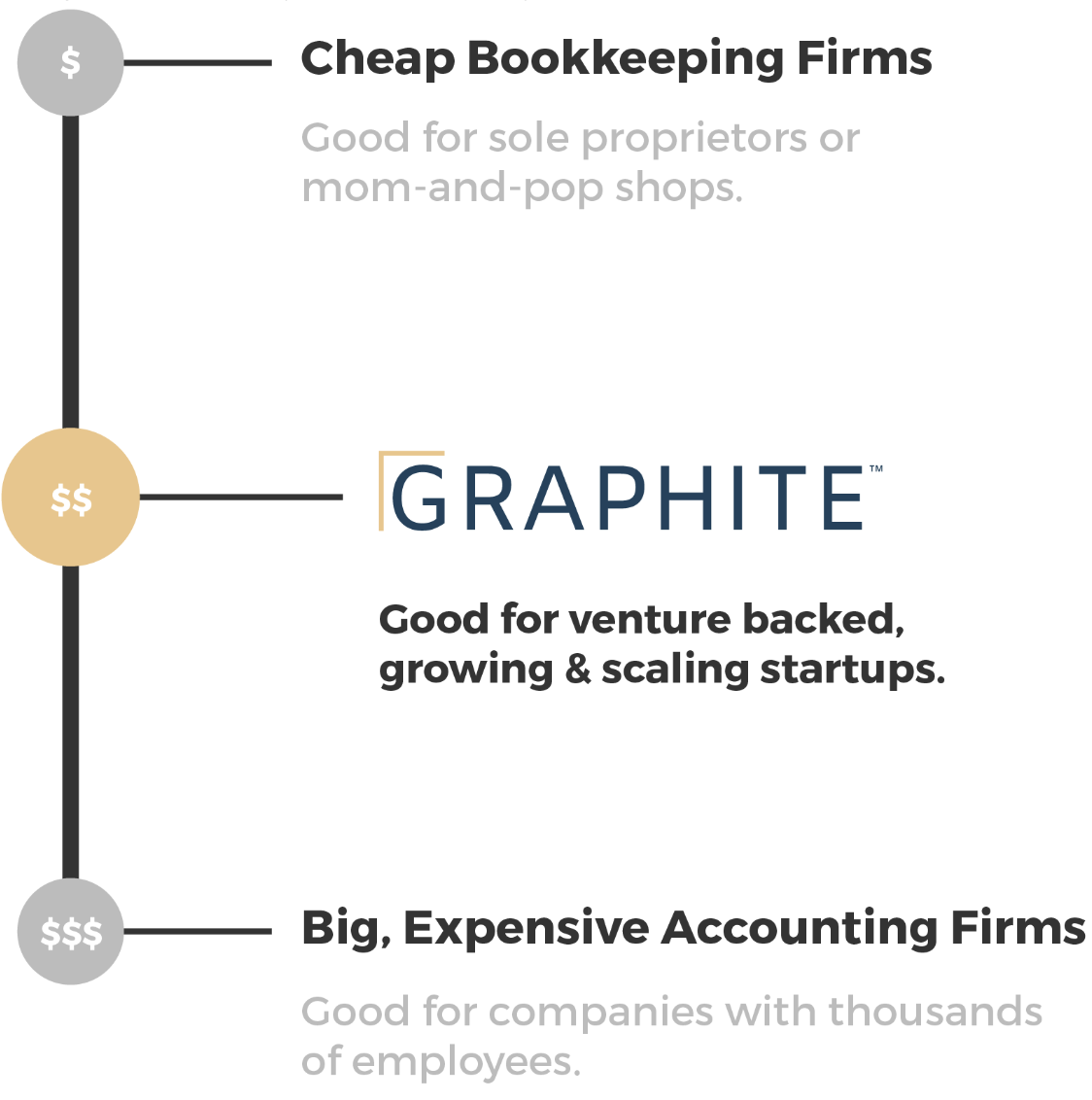

For startups working with a limited budget, a low-cost accounting firm seems appealing. However, low-cost firms almost always come with a catch.

In many cases, the accounting firm takes on an extremely high volume of clients to offset their low costs. Not only will these firms not have time to prioritize your startup when you need extra support, but there will also inevitably be compromises on the quality of the work.

We’ve seen this time and time again, as many of Graphite’s clients have come to us after poor experiences with “budget-friendly” accounting firms.

In other cases, accounting firms keep their prices low because they’re willing to make little to no profit. This inevitably leads to internal problems for them down the line, which means they won’t be a reliable partner for you in the long term.

Here’s the big problem with low-cost firms. Poor-quality accounting and financial planning processes have serious consequences for startups.

Your startup needs accurate, well-presented financials to impress investors and to make critical operating decisions, like understanding your runway to a T. Low-cost firms just aren’t able to provide this.

A quality firm limits the number of clients each team member at their company can work with, hence the slightly higher price tag.

They’re Just a Bookkeeping Firm

Bookkeeping is just one piece of a startup’s financial puzzle. While high-growth startups do need bookkeeping services, they also need support with GAAP compliance (needed for fundraising) and financial strategies.

At this stage, your finances are changing rapidly, and investors will expect extensive documentation. Bookkeeping alone isn’t going to help you use financial data to tell your startup’s story to investors or make crucial long-term decisions about your financial strategy.

Even if bookkeeping is all you think you need at this moment, you’re likely to outgrow a firm that only offers bookkeeping services in less than 6-8 months as your startup hits new growth milestones.

They’re Working With Too Many Clients At Once

One of the first questions to ask any potential accounting firm is about the number of accounts that each accountant handles at a time.

We’ve already noted that low-cost firms often have a huge number of clients and not enough accountants to handle them. However, many higher-cost firms do this too, with less-than-stellar results.

High-growth startups need much more financial support and attention than the average organization. It takes time and energy to get to know your startup inside and out, enabling accountants to give you sound financial advice that fits the unique business needs of your startup.

If you choose a firm that has its accountants working with 20 or even 50 clients at a time, this just isn’t going to work. Even with the most advanced automation tools, there are still only so many accounts a firm can handle at once and still be effective.

They’re a Shared Service Center

Many firms that market themselves as startup accounting firms actually operate as a shared service center. This is a huge red flag that every startup should watch out for when selecting a new accounting partner.

In this shared service center business model, account managers and their teams serve as customer service representatives rather than financial professionals. The work itself is then outsourced to low-cost external service providers, many of whom are offshore.

With the hands-on nature of startup finances, this approach doesn’t work for early-stage and growing companies, especially when it comes to financial planning and high-level decision-making. When selecting a firm to work with, be sure to ask who will be doing the accounting work and what type of relationship you will have with them.

Avoid All of These Red Flags By Choosing Graphite

There are many basic bookkeeping firms out there, but very few operationally focused startup accounting firms like Graphite. Our business model focuses on high-touch and long-term engagements, where we take our clients from seed all the way through exit.

Here’s a quick overview of our services. If you’re ready to learn how we can specifically support your startup, reach out to the Graphite team.